Furthermore, credit bureau data reveals a concerning trend in Thailand's loan market, with a significant rise in non-performing housing loans, particularly among lower-income buyers struggling to meet mortgage payments. This amounts to approximately 120 billion baht, predominantly from those purchasing homes priced below 3 million baht – a consumer segment with low to moderate income levels. This situation is exacerbated by the soaring cost of living.

In addition, our company faced volatility in the debenture market, necessitating an extension of bond maturities by two years, which was met with favorable cooperation from the majority of our bondholders.

Looking ahead to 2025, the market is expected to remain challenging, requiring adaptation and increased caution from all stakeholders. We anticipate another year of inventory reduction and limited new project launches due to fragile purchasing power. Government measures to stimulate the real estate sector will be crucial, including potential reductions in transfer and mortgage fees, and the Bank of Thailand's relaxation of LTV measures.

Despite these challenges, our company remains committed to sustainable business practices, prioritizing product quality, brand building, construction quality, and after-sales service, with a continued focus on customer satisfaction.

In 2025, we plan to continue seeking investment partners, leveraging our land bank for development and ongoing projects. This positions us favorably for economic recovery.

In closing, I extend my sincere gratitude to our shareholders, business partners, financial institutions, and bondholders for their continued trust and support. I also express my heartfelt appreciation to our dedicated executives and employees for their unwavering commitment and hard work, which has enabled our company to navigate these challenging times admirably.

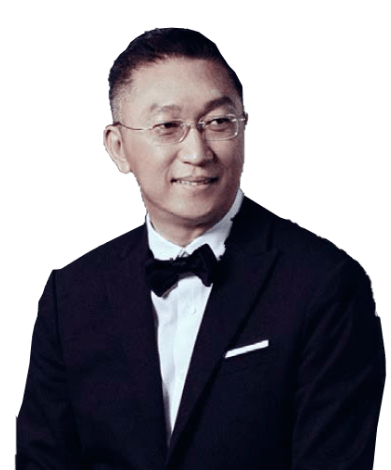

Mr. Wisit Laohapoonrungsee

Chairman and Chief Executive Officer